solution

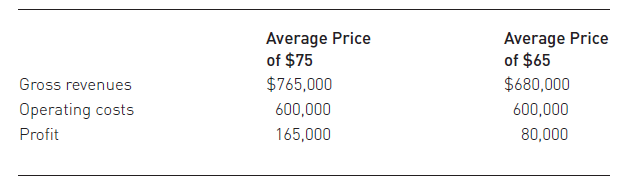

On March 3, 2008, a revival of Gypsy, the Stephen Sondheim musical, opened

at the St. James Theater in New York. Ticket prices ranged from $117 to $42 per

seat. The show’s weekly gross revenues, operating costs, and profit were estimated

as follows, depending on whether the average ticket price was $75 or $65

With a cast of 71 people, a 30-piece orchestra, and more than 500

costumes, Gypsy cost more than $10 million to stage. This investment

was in addition to the operating costs (such as salaries and theater rent).

How many weeks would it take before the investors got their money

back, according to these estimates, if the average price was $65? If it

was $75? b. George Wachtel, director of research for the League of American Theaters

and Producers, has said that about one in three shows opening on Broadway in recent years has at least broken even. Were the investors in Gypsy taking a substantial risk? c. According to one Broadway producer, “Broadway isn’t where you make the money any more. It’s where you establish the project so you can make the money. When you mount a show now, you really have to think

about where it’s going to play later.” If so, should the profit figures here be interpreted with caution? d. If the investors in this revival of Gypsy make a profit, will this profit be, at least in part, a reward for bearing risk?

Ă‚Â

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"