solution

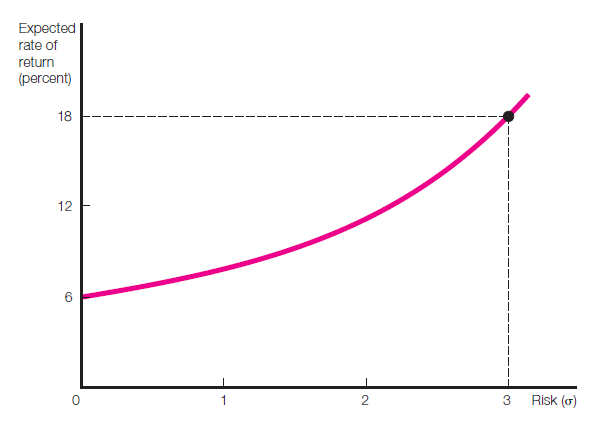

William J. Bryan is the general manager of an electrical equipment plant. He

must decide whether to install a number of assembly robots in his plant. This

investment would be risky because both management and the workforce have

no real experience with the introduction or operation of such robots. His

indifference curve between expected rate of return and risk is as shown in the

figure. a. If the riskiness (s) of this investment equals 3, what risk premium does

he require? b. What is the riskless rate of return? c. What is the risk-adjusted discount rate?

d. In calculating the present value of future profit from this investment, what interest rate should be used?

ÃÂ

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"