solution

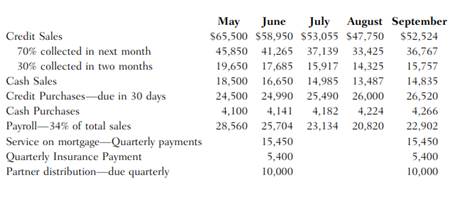

The Watree Lodge is struggling with cash flow and has been waiting until the last minute to pay its vendors. The Watree is a beautiful ski lodge located in a popular area, but during the summer months hotel guests become scarce and cash management becomes a major problem. Because the Watree is independently owned and operated, every once in a while, the owners must provide additional funds to carry the business over. Mr. Tom Broli has just been hired as the controller at the Watree and is in the process of analyzing all of its financial statements. The previous controller had to be replaced because he did not have an understanding of the business and knowledge of cash management. The general manager hired Mr. Broli because he heard that Tom was an experienced controller and very competent in financial management. Tom’s first goal is to look at cash forecasts to help him determine where he can make improvements. 1. From the information provided in the chart, determine available cash for the months of July, August, and September. Assume a beginning cash balance of $(10,000) in July. 2. How can this property better manage its working capital? Provide specific suggestions for Watree Lodge management.

ÂÂ

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"