solution

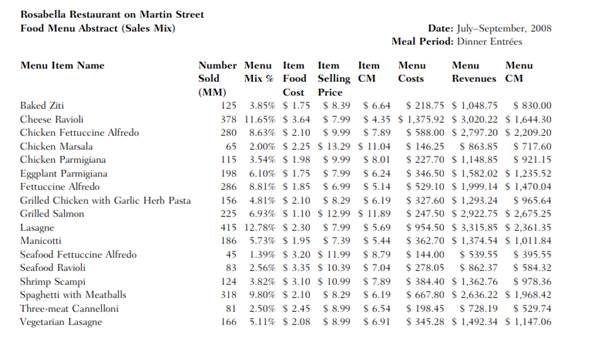

Rosabella Restaurants is a popular Italian restaurant chain located in the southwestern United States. Typical Italian food such as ravioli, lasagne, and fettuccine Alfredo can be purchased at a reasonable price at these family-friendly restaurants. All of the restaurants are owned and operated by Rosabella Restaurants, Inc. Ms. Jennifer Churchman, a regional controller for Rosabella Restaurants, has seen decreasing profits from one of the properties in her region and is in the process cause of this problem. Ms. Churchman requested financial information from the property, including a food menu abstract, to get the entire picture of the restaurant’s operations. The restaurant general manager provided all of the requested information. Below is the food menu abstract for dinner entrees over the last three months. Ms. Churchman has asked you to analyze the food menu abstract and given you the following questions to answer: Q UESTIONS 1. Do there appear to be any abnormalities with the report? Look for any items that seem unusual, such as item food cost. 2. Analyze the report. Which items have the highest contribution margin? Which items have the lowest contribution margin? 3. What advice can you provide to the restaurant manager for improving the restaurant’s sales mix?

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"