solution

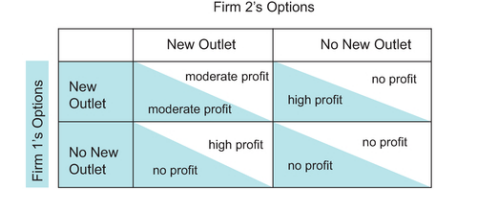

Suppose that two oligopolistic retail chains are considering opening a new sales outlet in a particular town. The changes to each firm’s profits, depending on the actions taken, are given in the following payoff matrix. If a chain does not open a new outlet, it earns no addition to profits. If one of the chains is the only one to open an outlet, it makes high additional profits. If they both open outlets, they have to split the available market, and they make only more moderate additional profits.

a. If Firm 1 decides to open a new outlet, but Firm 2 does not open a new outlet, how much additional profit does each firm make?

b. If Firm 1 decides to open a new outlet, what is the worst that can happen to it? If Firm 1 decides not to open a new outlet, what is the worst that can happen to it? Which option, then, should Firm 1 choose, if it wants to make the choice that leaves it best off, regardless of what the other firm does?

c. If the firms are noncooperative and each firm makes the choice that will leave it best off regardless of the other’s choice, what will the outcome be?

d. Is this like the “prisoner’s dilemma,” in which both parties could get a better outcome by communicating and cooperating?

e. Now suppose that each firm is thinking of opening new outlets in a number of towns, and each town has a payoff matrix similar to this one. Would there be advantages in having the two chains communicate and cooperate in this case? If they decide to collude, what form do you think their collusion might take?

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"