solution

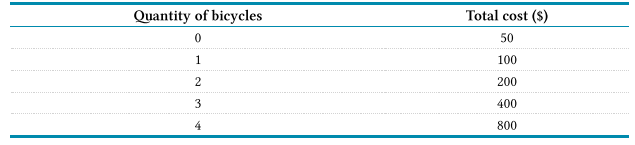

Suppose a firm that manufactures bicycles has the following cost structure:

a. How muîâ¬Â» does this firm have in fixed costs?

b. Using graph paper or a computer program, graph the total cost curve for this firm. Suppose that bicycles sell for $200 each, and the firm is a price taker. Create a table showing the marginal cost, total cost, marginal revenue, total revenue (price Ãâ quantity), and total profit (total revenue ââ¬â total cost) at each level of production.

c. Add a total revenue curve to the graph that you created in (b). Indicate with arrows the approximate quantity at which the vertical distance between the two curves is the greatest.

d. Would the firm make a profit by producing and selling only one bicycle? Would one bicycle be the best output level for the firm? What is the output level that maximizes profits?

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"