solution

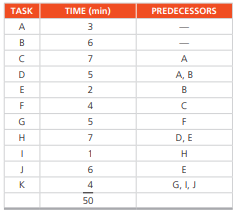

Dr. Lori Baker, operations manager at Nesa Electronics, prides herself on excellent assembly-line balancing. She has been told that the firm needs to complete 96 instruments per 24-hour day. The assembly-line activities are:

a) Draw the precedence diagram.

b) If the daily (24-hour) production rate is 96 units, what is the highest allowable cycle time?

c) If the cycle time after allowances is given as 10 minutes, what is the daily (24-hour) production rate?

d) With a 10-minute cycle time, what is the theoretical minimum number of stations with which the line can be balanced?

e) With a 10-minute cycle time and six workstations, what is the efficiency?

f) What is the total idle time per cycle with a 10-minute cycle time and six workstations?

g) What is the best workstation assignment you can make without exceeding a 10-minute cycle time, and what is its efficiency?

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"