solution

Case Study

Customer experience management at ResponseTek

By means of CEM, a company can incorporate the voice of its customers into its business strategies and operations. The aim is the development of trust and loyalty that will lead to the ultimate goal of advocacy. According to ResponseTek, it is not sufficient simply to monitor the impact of advocacy and satisfaction of one’s customers. Instead, it is necessary to take customer advocacy and satisfaction to a higher level of understanding by enabling a company to understand the root cause of customer satisfaction and advocacy. Once such root causes are identified, effective, well-focused actions can be implemented to increase satisfaction, advocacy and profitability. ResponseTek claims that its core suite is the only software platform that delivers a complete set of Customer Experience Management capabilities, comprising:

● Multi-channel experience collection

● Analysis

● Reporting

● Workflow management

● Closed-loop feedback.

The CEM methodology is based upon three core elements, namely:

1. Involve: capture the customer’s experience whenever and wherever it occurs. This means continuously gathering customer insights – whether customer, company or event-initiated – from any channel, such as the call-centre, web or in-store point of sale, when they want, and when their opinions are formed at the moment of delight or disappointment.

2. Integrate: integrate the customer’s voice into processes and employee activities. Staff, partners and executives need to be able to make informed decisions based on real-time customer-experience information. The right information needs to be filtered to the right person at the right time, from the executive level down to frontline employees. Users should be able to communicate improvements or comments back to the customer.

3. Improve: continuously turn customer experience insight into actionable improvements. The ability to facilitate enterprise-wide communication and change based on customer experience information is another critical aspect in achieving the greatest customer experience management benefits. Actionable, closed-loop communication capabilities enable companies to align business strategies with customer insights, and in the process create customer advocates.

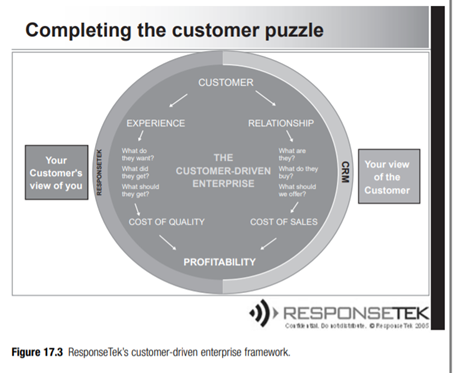

Figure 17.3 shows how ResponseTek seeks to integrate all aspects of CEM into a unified conceptual framework described as the customer-driven enterprise.

Aon Reed Stenhouse (ARS) is one of a number of financial services organizations using ResponseTek’s system. ARS is the Canadian division of AON, a global provider of risk management and insurance broking services. Faced with increasing competition and limited understanding of its customers, ASR was looking for an efficient solution to improve retention, improve understanding of customers and, through that better understanding, improve the customer experience, this allowing ASR to set itself aside from the competition. ResponseTek implemented a system of ASR which provided regular monitoring of real-time customer experiences, a ‘dashboard’ system to provide senior management with daily summaries of the customer experience by segment and by region, and an early warning system for ‘at risk’ customers (potential defectors) on a daily basis.

David Cliche, marketing manager for ASR summarized the benefits of implementing CEM:

We had to respond to the changing competitive landscape of the Insurance industry and look for alternative ways to make better informed business decisions. ResponseTek helped us to accomplish this by integrating the voice of the customer into our business processes … We now know a lot more about

our customers than we did before. Rather than one touchpoint, we are now able to understand our interactions with customers throughout their lifecycle. Knowing what our customers want and the complementary products and services they need is invaluable information.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"