solution

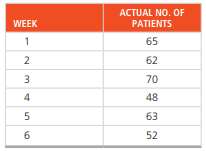

Refer to Problem 4.2. Develop a forecast for years 2 through 12 using exponential smoothing with a = .4 and a forecast for year 1 of 6. Plot your new forecast on a graph with the actual data and the naive forecast. Based on a visual inspection, which forecast is better?

Problem 4.2

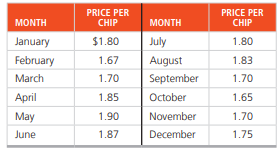

![]()

a) Plot the above data on a graph. Do you observe any trend, cycles, or random variations?

b) Starting in year 4 and going to year 12, forecast demand using a 3-year moving average. Plot your forecast on the same graph as the original data.

c) Starting in year 4 and going to year 12, forecast demand using a 3-year moving average with weights of .1, .3, and .6, using .6 for the most recent year. Plot this forecast on the same graph.

d) As you compare forecasts with the original data, which seems to give the better results?

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"