solution

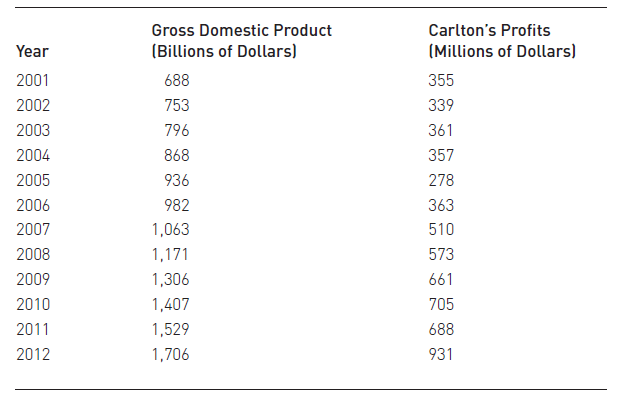

Mary Palmquist, a Wall Street securities analyst, wants to determine the relationship

between Chile’s gross domestic product (GDP) and the profits (after taxes)

of the Carlton Company. She obtains the following data concerning each variable

What are the least-squares estimates of the intercept and slope of

the true regression line, where Carlton’s profits are the dependent

variable and GDP is the independent variable? b. On the average, what effect does a $1 increase in gross domestic product seem to have on the profits of Carlton?

c. If Ms. Palmquist feels that next year’s GDP will be $2 trillion, what

forecast of Carlton’s profits will she make on the basis of the

regression? d. What is the coefficient of determination between the nation’s gross

domestic product and Carlton’s profits? e. Do the results obtained in previous parts of this problem prove that changes in Carlton’s profits are caused by changes in the gross domestic

product? Can we be sure that Carlton’s profit is a linear function of the

GDP? What other kinds of functions might be as good or better?

f. If you were the financial analyst, would you feel that this regression line

was an adequate model to forecast Carlton’s profits? Why or why not?

Ă‚Â

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"