solution

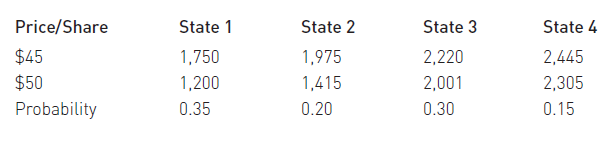

Consultant.com is a company that employs business professors as virtual

consultants who supply answers to other companiesââ¬â¢ problems. Consultant

.com wants to raise funds with a private equity issue. Unfortunately, because

of fluctuations in the stock market, it is uncertain about the demand for its

offering. It hopes to issue the stock at either $45 or $50. The demand is categorized

into four possible scenarios. The following table shows demand for each

scenarioââ¬âprice combination along with the beliefs regarding the probability of

each possible state. Consultant.com must pay 10% of the generated funds to

the investment bank that helped it identify potential investors. The company

wants to maximize the funds raised.

What is the expected value of the stock offering if Consultant.com sets its

price without knowing the future demand state? If Consultant.com can determine

the future demand state by using a modified Dutch auction, what is its

expected profit? If someone approached Consultant.com and told managers

she could predict the future demand state, how much would that information

be worth to them?

ÃÂ

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"